The Future of Money is Multi-Rail: Navigating the Evolving Payment Landscape, which will have significant implications for the global economy.

The way we pay for goods and services is evolving faster than ever before. Traditional payment systems like Real-Time Gross Settlement (RTGS) and credit cards have long dominated the financial ecosystem. However, the introduction of newer innovations such as open banking, stablecoins, Central Bank Digital Currencies (CBDCs), and programmable payments is fundamentally reshaping how we think about money. The shift is not just a change in technology; it’s a transformation in how we interact with financial systems.

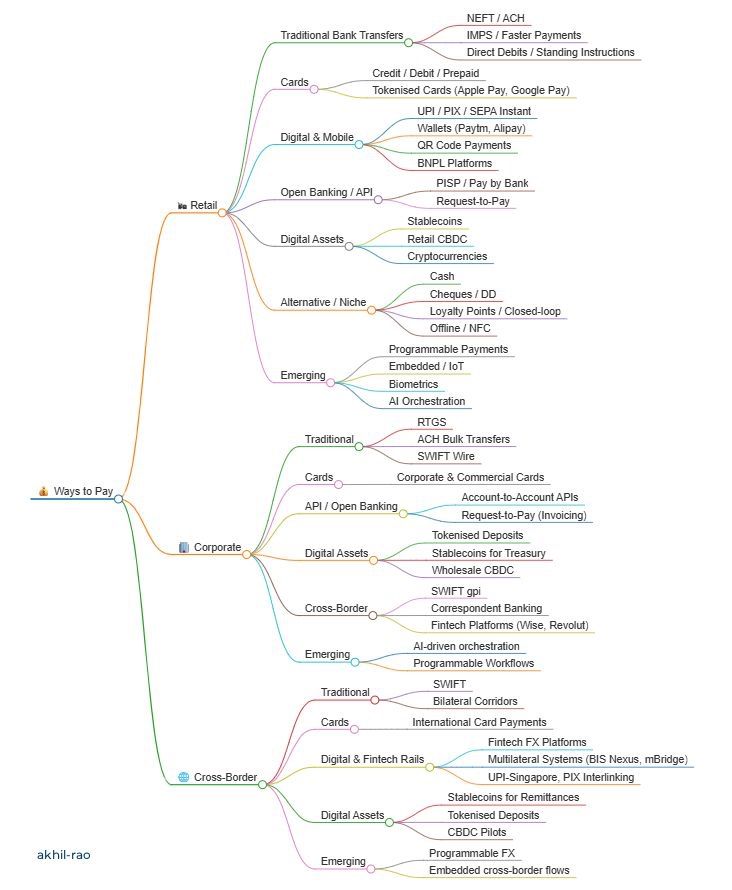

Today, payment methods span a wide variety of fields, creating a complex, multi-dimensional network. These payment rails are no longer isolated systems; they are increasingly overlapping, converging, and evolving. As a result, we’re witnessing the emergence of a more flexible, efficient, and secure global payment infrastructure. The diagram below compares various payment methods based on use cases across retail, corporate, and cross-border transactions.

In this rapidly evolving landscape, I believe the future of payments will not be dominated by a single “mainstream” system. Instead, we’ll see a multi-rail environment, where different payment methods coexist, each serving distinct purposes. Traditional systems like bank transfers and credit card payments will continue to play key roles, but emerging technologies such as digital currencies will provide viable alternatives. The key to the future of payments will lie in finding the right balance between these diverse systems.

Consider cross-border payments as an example. Currently, international money transfers often face high fees and long processing times. However, stablecoins and CBDCs are increasingly being seen as ideal solutions for global payments. These digital assets offer significantly lower transaction costs and faster settlement times compared to traditional banking methods. As regulatory frameworks mature, stablecoins and CBDCs will likely gain wider acceptance, transforming how global transactions are conducted.

At the same time, within domestic markets, traditional payment methods such as credit cards and bank transfers will remain dominant. However, innovations like open banking and programmable payments are expected to disrupt established systems. Open banking, for example, allows third-party providers to access customer banking data (with consent), creating opportunities for new financial products and services. Programmable payments, which enable payments to be triggered automatically based on predefined conditions, will further streamline payment processes and facilitate new business models.

The rise of decentralized finance (DeFi) platforms and digital wallets also represents a significant shift in how consumers and businesses interact with money. In the future, financial services may be decentralized, allowing individuals to control their assets directly, bypassing traditional intermediaries like banks. This will introduce new opportunities for financial inclusion, especially in regions where access to traditional banking infrastructure is limited.

In conclusion, the future of payments isn’t just about choosing between a handful of options. It’s about embracing a multi-rail system, where different payment methods coexist, complement, and compete with each other. How we navigate and leverage this ecosystem will ultimately determine the direction of the payments industry. The future will not be defined by a single dominant technology, but by an interconnected network of payment systems that are flexible, efficient, and capable of meeting the needs of consumers, businesses, and governments alike.

Source from Akhil Rao