Stablecoins and Central Bank Digital Currencies (CBDCs) both represent digital forms of money, but they are distinct in several fundamental ways. Let’s break it down:

👉 Stablecoin: A stablecoin is a type of cryptocurrency designed to maintain a stable value. It achieves this by being pegged to an underlying reserve asset, such as a fiat currency (USD, EUR), commodities (gold), or even a basket of assets. The idea is to offer the benefits of digital assets—like fast, low-cost transactions—without the volatility typically associated with cryptocurrencies like Bitcoin.

👉 CBDC (Central Bank Digital Currency): A CBDC, on the other hand, is a digital version of a country’s national currency. Issued and regulated by a central bank, it is a direct representation of fiat money, providing a secure, government-backed alternative to traditional cash. CBDCs aim to enhance payment efficiency while ensuring the stability and trust that comes with a national currency.

Key Differences

🔹 Issuer

Stablecoin: Issued by private entities, such as companies or organizations, who manage the collateral that underpins the stablecoin. Examples include Tether (USDT) or DAI.

CBDC: Issued by a central bank or monetary authority. It’s a digital counterpart to physical currency, making it an official government-backed digital asset.

🔹 Backing

Stablecoin: Pegged to a specific reserve asset (like USD or gold), often in the form of a 1:1 collateralized backing, but there are also algorithmic stablecoins with more complex mechanisms.

CBDC: Directly backed by the central bank’s authority and reserves. It carries the full faith of the government, similar to physical currency.

🔹 Regulation

Stablecoin: Generally less regulated, although regulations are catching up. Stablecoins are subject to market forces, but governments are increasingly scrutinizing them due to concerns over financial stability and transparency.

CBDC: Highly regulated, as they are official legal tender. CBDCs are designed to maintain strict oversight by central banks and comply with national financial regulations.

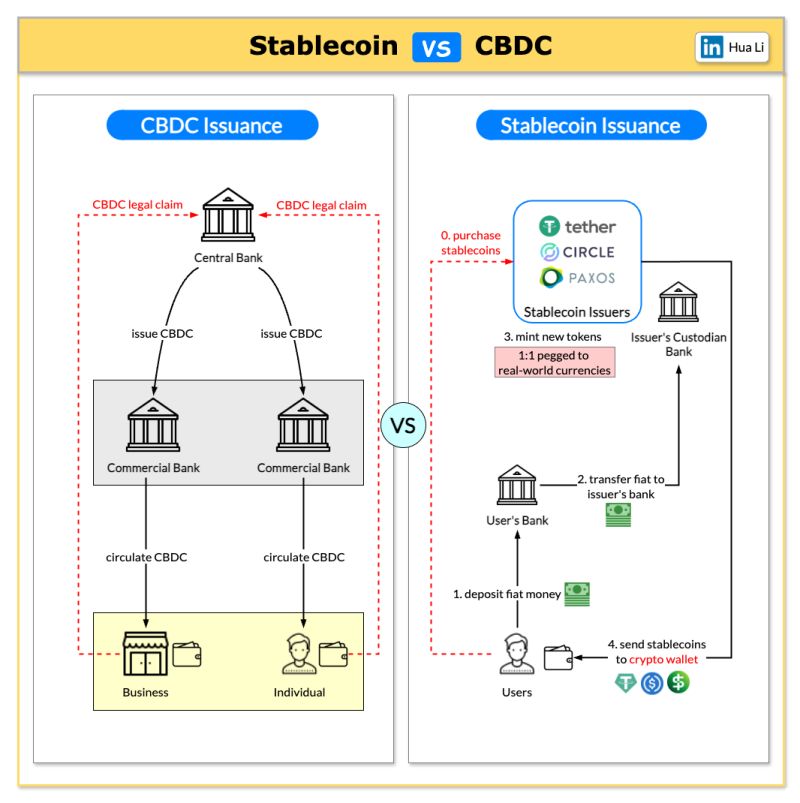

🔹 Issuance Process

Stablecoin: Stablecoins are issued based on the reserve assets they are pegged to, and users can redeem or mint stablecoins against these reserves.

CBDC: Issued and controlled by the central bank. Their issuance typically involves deep integration with national financial systems and legal frameworks, ensuring government control and oversight.

Here are some practical examples and use cases:

Stablecoin in Action: Let’s consider the use of Tether (USDT) for cross-border payments. If you’re an importer in Asia looking to purchase goods from Europe, you can use USDT to bypass traditional banking channels, reduce costs, and settle transactions almost instantly. Stablecoins offer a way to avoid the fees and delays associated with currency conversion and international wire transfers.

Another example is DAI, a decentralized stablecoin that allows users to borrow and lend in decentralized finance (DeFi) platforms. This use case provides flexibility and access to liquidity outside the traditional banking system.

CBDC in Action: China’s Digital Yuan (e-CNY) is already being tested and piloted for domestic payments. For example, during the Beijing Winter Olympics, foreign visitors were able to use digital yuan for payments via a government-approved digital wallet. This demonstrates the potential of CBDCs to enhance domestic transactions with instant settlement, lower fees, and greater security compared to cash or traditional cards.

Another example is The Bahamian Sand Dollar, which aims to improve financial inclusion by providing a government-backed digital currency that can be easily used by anyone with a mobile phone, even in remote areas.

Both stablecoins and CBDCs offer faster and cheaper transactions, particularly in cross-border payments. Stablecoins enable low-cost international remittances by bypassing traditional banks and their associated fees. Meanwhile, CBDCs, through central bank backing, promise a more secure, government-controlled alternative that can still offer instant settlement and low transaction fees for both domestic and cross-border payments.

In conclusion, The key difference lies in who issues and regulates the currency—stablecoins are privately issued and may be less regulated, while CBDCs are fully controlled by the state and designed to represent official currency. The world of digital payments is rapidly expanding, and these two digital money forms will likely coexist, serving different needs in different scenarios. Stablecoins will likely play a major role in decentralized finance and cross-border payments, while CBDCs will serve as a government-backed, digital alternative for everyday transactions, providing a more secure and regulated environment for national economies.

Source from Hua Li