Central bank digital currency (CBDCs) are often discussed as the public-sector response to stablecoins. But framing them as a competing payment rail misses the point.

In a multi-rail payment system, CBDCs are less about replacing existing rails — and more about extending the state’s monetary and settlement infrastructure into the digital era.

1️⃣ Retail vs. Wholesale CBDCs: A Critical Distinction

Not all CBDCs are designed for the same purpose.

• Retail CBDCs target consumers and merchants. They function as digital cash, with a focus on accessibility, inclusion, and resilience in domestic payment systems.

• Wholesale CBDCs are designed for banks and financial institutions, enabling direct central-bank settlement for interbank payments, securities settlement, and cross-border corridors.

Most large economies are prioritizing wholesale CBDCs, where efficiency gains are clearer and systemic risk is easier to manage.

2️⃣ CBDCs Are Infrastructure, Not a Go-To Payment Method

Unlike stablecoins, CBDCs are not optimized for:

• Global interoperability

• Rapid private-sector innovation

• Flexible integration into commercial workflows

Their primary role is to provide a risk-free settlement layer, anchored directly to the central bank’s balance sheet.

In that sense, CBDCs resemble upgraded RTGS systems more than consumer-facing payment products.

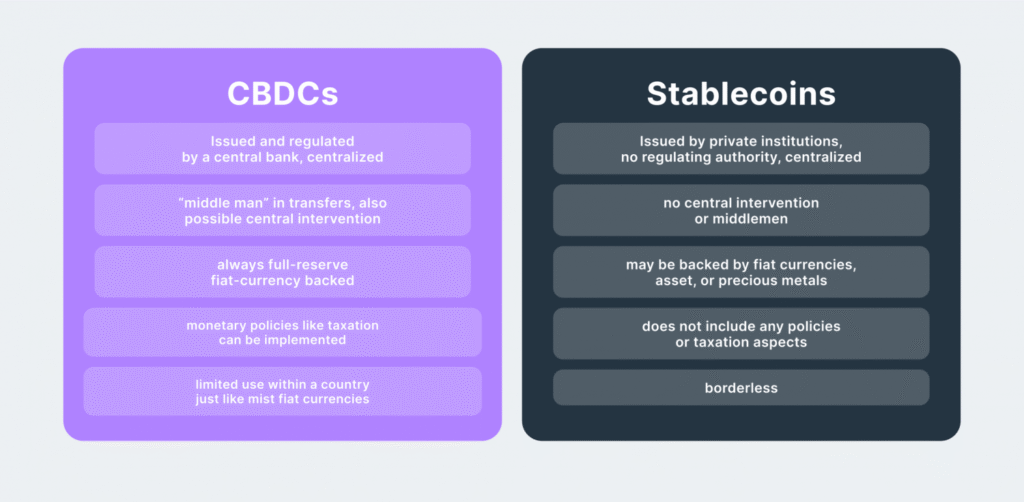

3️⃣ CBDCs and Stablecoins Are Not Substitutes

Stablecoins and CBDCs solve different problems.

• Stablecoins optimize for speed, cost, and global reach — especially in cross-border and B2B use cases.

• CBDCs optimize for control, settlement finality, and monetary sovereignty.

In practice, they are more likely to be complementary:

stablecoins operating at the edge of the system, while CBDCs sit at the core.

What This Means for a Multi-Rail Future? CBDCs will not become the dominant everyday payment rail for consumers or businesses. Their impact will be quieter, but deeper — reshaping how financial institutions settle, manage liquidity, and interact with central banks.

In a multi-rail world, CBDCs are best understood not as competitors to stablecoins, but as foundational infrastructure that other rails can build upon.