Why More EU Merchants Are Switching to Crypto Payments

Over the past year, more EU-based merchants have started to quietly rethink how they handle payments.

This shift isn’t driven by crypto hype or ideology. In most cases, it’s the result of very practical operational constraints — especially for businesses operating across borders.

For many merchants, the question is no longer “Is crypto mainstream?”

It’s “Does our current payment setup still make sense in the EU?”

The EU Payments Reality: Efficient on Paper, Friction in Practice

From the outside, Europe looks like a well-integrated payments market. In reality, many merchants still struggle with:

- High cross-border fees

- Slow settlement times

- Chargeback exposure

- Account freezes with limited transparency

- Heavy dependence on a small number of centralized providers

These issues become more visible as soon as a business operates across multiple EU countries, sells globally, or works with digital goods and services.

For SaaS, Web3, gaming, and digital content platforms, payments often become a bottleneck — not a growth enabler.

What Changed: Regulatory Clarity Is Catching Up

One of the biggest reasons crypto payments are being reconsidered in the EU is regulatory clarity.

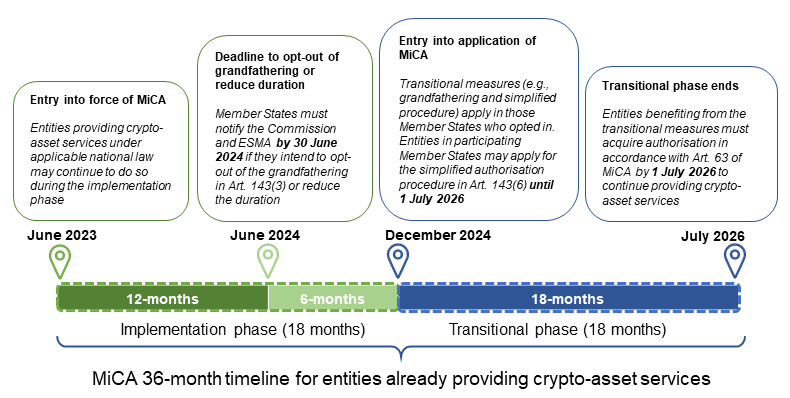

With MiCA coming into force, many merchants are no longer viewing crypto payments as a legal grey area. Instead, they’re evaluating them as infrastructure — especially for use cases where traditional rails struggle.

This doesn’t mean every merchant is switching overnight.

But it does mean crypto payments are now part of serious internal discussions.

What EU Merchants Actually Care About (It’s Not “Crypto”)

In conversations with EU merchants, the same themes come up repeatedly. The interest in crypto payments is usually driven by a few concrete needs:

1. Reliable Cross-Border Settlement

Merchants want payments that work consistently across markets without layered intermediaries or unpredictable delays.

2. Reduced Dependency Risk

Relying on a single payment provider can be risky. Diversifying payment rails is increasingly seen as operational resilience, not experimentation.

3. Predictable Fees

Transparent, predictable costs — especially for international transactions — matter more than marginal fee optimization.

4. Compliance That Works in the EU

Merchants aren’t looking to bypass regulation. They want solutions that are compatible with EU compliance requirements and operational realities.

Crypto payments are being evaluated not as a replacement for everything — but as a complementary rail where traditional systems fall short.

From “Experiment” to Infrastructure Conversation

A noticeable change is how these discussions happen internally.

Instead of asking “Should we try crypto?”, teams are asking:

“Does this actually work in the EU — compliantly and at scale?”

That shift in framing matters. It signals that crypto payments are moving from experimentation into infrastructure evaluation.

For many EU merchants, the decision isn’t ideological. It’s about whether their payment stack supports how their business actually operates today.

A Quiet Shift, Still Early — But Hard to Ignore

This transition is still in its early stages. Most EU merchants aren’t making loud announcements or dramatic switches.

But the conversations are happening — often quietly, internally, and driven by real operational pressure rather than trends.

As regulatory clarity improves and cross-border commerce continues to grow, alternative payment rails are becoming harder to ignore.

Not because they’re new —

but because the problems they address are very real.

UnusPay work with merchants building in the EU who are exploring compliant crypto payment infrastructure.